reverse sales tax calculator ny

New York has 2158 special sales tax. Designed for mobile and desktop clients.

How To Calculate Sales Tax Backwards From Total

The range of sales tax may vary from state to state like in New York the state rate is 4.

. Tax 2925 tax value rouded to 2 decimals Add tax to the before tax price to get the final price. North Carolina NC 4750. Tax Title and Tags not included in vehicle prices shown and must be paid by the purchaser.

Depending on the zipcode the sales tax rate of New York City may Find your GSTHST rebate for a new home. Multiply the price of your item or service by the tax rate. Subtract that from the receipts to get your non-tax sales revenue.

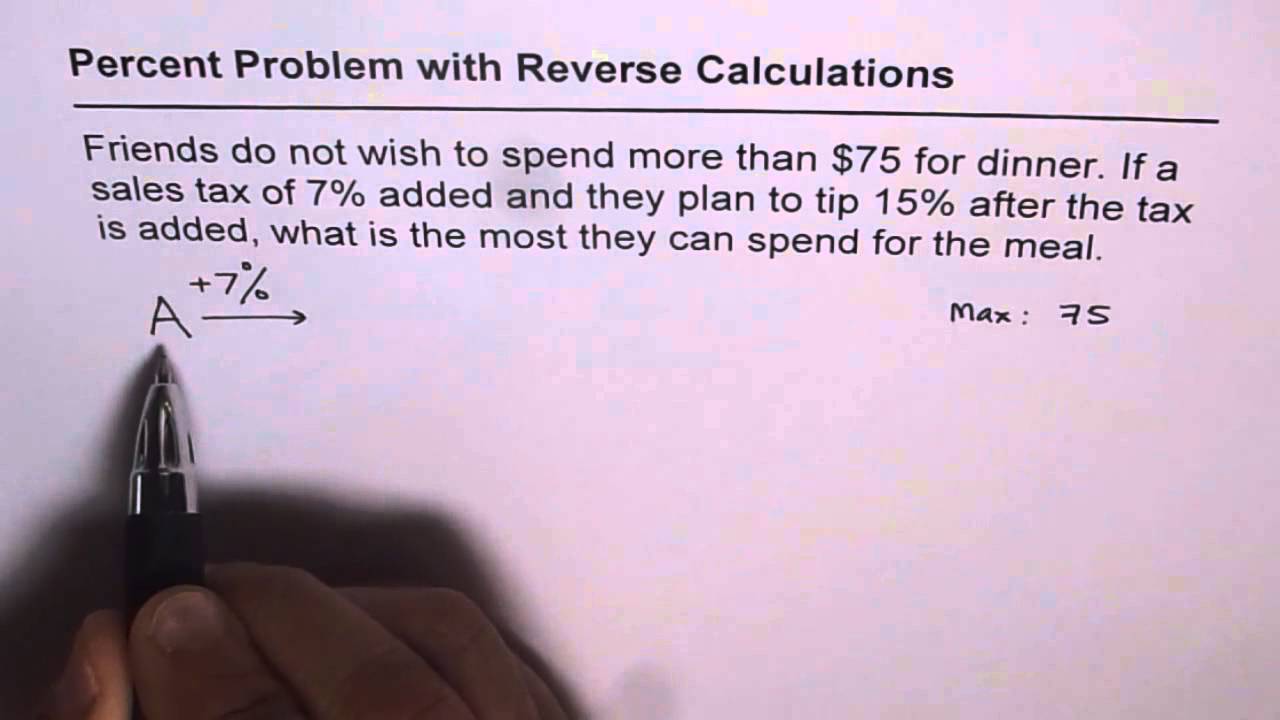

The only thing to remember in our Reverse Sales. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. The sales tax added to the original purchase price produces the total cost of the purchase.

The New York state sales tax rate is 4 and the average NY sales tax after local surtaxes is 848. Use the Sales Tax Calculator to calculate sales taxes on a pretax sale price or in reverse from a tax-included price. New York Sales.

You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code. Instantly calculate sale tax with the help of a purchase tax calculator to contact your state taxing authority. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

As stated above on purchases made in New York State sales tax paid to one locality in New York is allowed as a credit against use tax due in another locality in New York. The second script is the reverse of the first. New York has a 4 statewide sales tax rate but also has 640 local tax.

Subtract the dollars of tax from step 2 from the total. If you know the total sales price and the sales tax percentage it will calculate. That entry would be 0775 for the percentage.

Reverse sales tax calculator ny Sunday June 12 2022 Edit. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. For example suppose your sales receipts are 1100 and the tax is 10 percent.

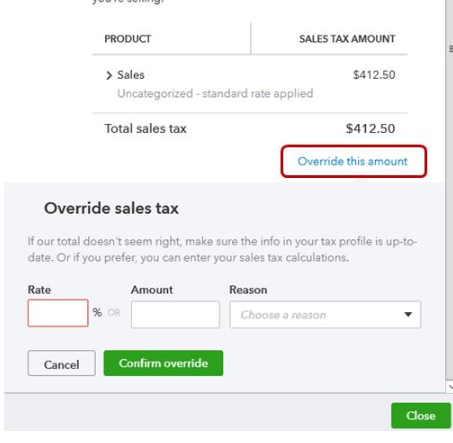

Check out flexible QuickBooks sales tax software for your business to track sales sales tax and cash flow. How the Sales Tax Decalculator Works. TAX DAY NOW MAY 17th - There are -389 days left until taxes are.

Multiply the result from step one by the tax rate to get the dollars of tax. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent.

To easily divide by 100 just move the decimal point two spaces to the left. To find the original price of an item you need this formula. To calculate the amount of sales tax to charge in New York City use this simple formula.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. You can use this method to find the original price of an item after a. View our Williams Toyota of Elmira inventory to find the right vehicle to fit your style and budget.

Find list price and tax percentage. That entry would be 0775 for the percentage. Subscribe to Sales tax to receive emails as we issue guidance.

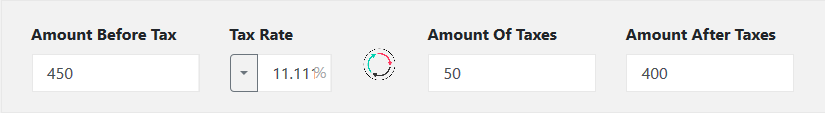

Last updated November 27 2020. Divide 1100 by 11 and you get 1000. I have included the following reverse sales tax calculator for calculating the before-tax price and sales tax amount from the final amount paid.

New York on the other hand only raises about 20 percent of its revenues from the. Reverse Sales Tax Calculator. 75100 0075 tax rate as a decimal.

Now find the tax value by multiplying tax rate by the before tax price. Use this app to split bills when dining with friends or to verify costs of an individual purchase. For information on the Oneida Nation Settlement Agreement see Oneida Nation.

52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. Start filing your tax return now. Groceries prescription drugs and non-prescription drugs are exempt from the New York sales tax.

Use this app to split bills when dining with friends or to verify costs of an individual purchase. Before-tax price sale tax rate and final or after-tax price. Reverse sales tax calculator of york calculation of the general sales taxes of the city york maine for 2021 q2 amount after taxes sales tax rates 55 amount of.

And several of these states raise nearly 60 percent of their tax revenue from the sales tax. A calculator to quickly and easily determine the tip sales tax and other details for a bill. In County X where the combined state and local tax is 7 4 state rate and 3 local.

Sales tax rates can change over timethe calculator provides estimates based on current available rates. Divide your sales receipts by 1 plus the sales tax percentage. The final price including tax 390 2925 41925.

Use tax applies if you buy tangible personal property and services outside the state and use it within New York State. The current total local sales tax rate in Montrose NY is 8375. Our free online New York sales tax calculator calculates exact sales tax by state county city or ZIP code.

With QuickBooks sales tax rates are calculated automatically for each transaction saving you time so you can focus on your business. Sales tax amount or rate. Then use this number in the multiplication process.

Instead of using the reverse sales tax calculator you can compute this manually. Two methods of calculating the use tax due are available for individuals. Sales tax total amount of sale x sales tax rate in this case 8.

New York NY 4000. Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due. Counties and cities can charge an additional local sales tax of up to 4875 for a maximum possible combined sales tax of 8875.

If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Reverse sales tax calculator ny Monday March 7 2022 Edit.

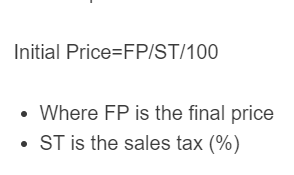

Multiply the result by the tax rate and you get the total sales-tax dollars. Sales tax applies to retail sales of certain tangible personal property and services. Take the total price and divide it by one plus the tax rate.

OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price. Divide tax percentage by 100 to get tax rate as a decimal. Reverse Sales Tax Calculator to calculate price before tax and the tax amount based on the final price and sales tax percentage.

The Excel sales tax decalculator works by using a formula that takes the following steps. Enter the sales tax percentage. Or to make things even easier input the NYC minimum combined sales tax rate into the calculator at the top of the page along with the total sale amount to get all the detail you need.

Reverse Sales Tax Calculator 100 Free Calculators Io New York Sales Tax Calculator Reverse. How to Calculate Sales Tax. Us Sales Tax Calculator Reverse Sales Dremployee A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

What is the tax value. Tax 390 0075. Sales Tax Calculator.

However it is 7 in Tennessee.

Us Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Reverse Sales Tax Calculator Calculator Academy

How To Calculate Amount With Percent Tax And Tip With Reverse Calculations Youtube

Reverse Sales Tax Calculator Calculator Academy

Stripe Tax Automate Tax Collection On Your Stripe Transactions

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

How To Calculate Sales Tax Backwards From Total

Sales Tax Recovery Reverse Sales Tax Audit Pmba

Reverse Sales Tax Calculator 100 Free Calculators Io

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

New York Sales Tax Calculator Reverse Sales Dremployee

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit